The upward thrust and fall of Silicon Valley Financial institution: Timeline of tech lender’s cave in

Contents

FED’S INTEREST RATE HIKE

When the Fed began elevating rates of interest aggressively closing 12 months to tame inflation, upper borrowing prices slowed the momentum of tech corporations that have been the supply of SVB’s enlargement.

As undertaking capital dried up because of emerging rates of interest and fears of a recession, SVB’s shoppers tapped their deposits to get the cash they had to stay going.

Upper rates of interest additionally eroded the worth of long-date fastened pastime bonds that SVB purchased, making it susceptible to the shift in financial coverage by way of the Fed.

SVB CEO SOLD COMPANY STOCKS

Lower than two weeks ahead of SVB printed the level of its losses, CEO Greg Becker bought US$3.6 million price of corporate inventory.

It was once the primary time in additional than a 12 months that he had bought stocks of mother or father corporate SVB Monetary Team, consistent with regulatory filings.

Rankings company Moody’s later warned the corporate of a possible downgrade.

In keeping with resources who spoke to Reuters, Becker referred to as Goldman Sachs bankers for recommendation and flew to New York for conferences with Moody’s and different scores corporations, apprehensive that the downgrade may just undermine investor self assurance in SVB’s monetary well being.

PLAN TO SHORE UP FINANCES

On Mar 8, SVB Monetary Team introduced it had bought US$21 billion of securities from its portfolio at a lack of US$1.8 billion, and that it could promote US$2.25 billion in new stocks to shore up its budget.

This backfired.

Challenge capitalists, unnerved by way of the plan, recommended their portfolio companies to withdraw their cash from the financial institution. The capital-raising plan resulted in SVB’s inventory collapsing 60 in step with cent.

On Mar 9, SVB Monetary Team scrambled to reassure its undertaking capital shoppers their cash was once secure.

COLLAPSE OF SVB

Through the morning of Mar 10, buying and selling in SVB stocks was once halted.

US government swooped in and seized the belongings of SVB, after it was transparent {that a} run on deposits made it now not tenable for the financial institution to stick afloat by itself.

The financial institution was once put into receivership by way of the FDIC. This in most cases method a financial institution’s deposits might be assumed by way of every other wholesome financial institution, or the FDIC can pay depositors as much as the insured prohibit.

It’s the greatest financial institution failure since Washington Mutual in 2008, and in addition the second-largest failure for a retail financial institution in america.

EMERGENCY MEETING OF US REGULATORS

According to the surprising cave in, Treasury Secretary Janet Yellen convened an emergency assembly of best US banking regulators on Mar 10.

She and the White Space expressed self assurance of their skills to answer the financial institution failure, and unveiled a chain of measures aimed toward restoring self assurance within the banking sector and settling turbulent markets.

After financial institution shoppers had been left stranded, monetary businesses mentioned in a joint commentary on Mar 12 that SVB depositors would have get admission to to “all in their cash”.

Yellen mentioned the transfer will give protection to “all depositors”, signalling help to these whose accounts exceed the everyday US$250,000 threshold for FDIC insurance coverage.

“We’re taking decisive movements to offer protection to america financial system by way of strengthening public self assurance in our banking gadget,” the businesses mentioned.

SIGNATURE BANK SHUT

Simply two days after Silicon Valley Financial institution was once shuttered, state regulators closed New York-based Signature Financial institution – a industrial financial institution with non-public consumer workplaces in Connecticut, California, Nevada and North Carolina.

As of September, virtually 1 / 4 of Signature’s deposits got here from the cryptocurrency sector, however the financial institution had introduced in December that it could shrink its crypto-related deposits by way of US$8 billion.

Information of the 2 financial institution closures despatched shockwaves throughout world buying and selling flooring.

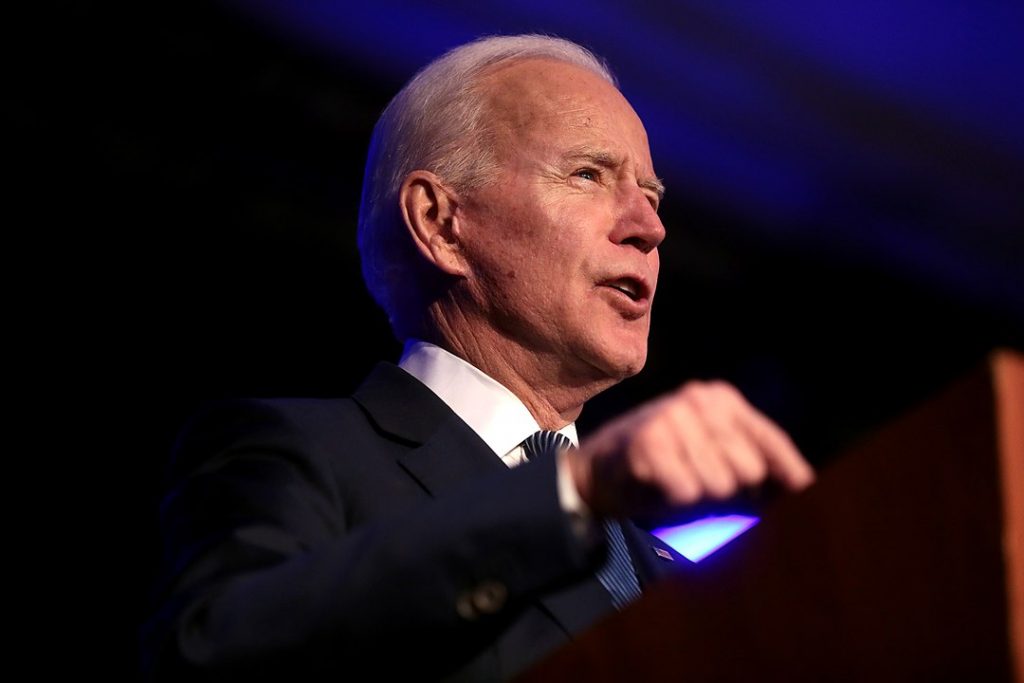

BIDEN REASSURES MARKETS

US President Joe Biden moved to reassure markets and depositors on Mar 13, after emergency measures to shore up banks by way of giving them get admission to to further investment did not dispel worries about possible contagion to different lenders.

“American citizens could have self assurance that the banking gadget is secure,” Biden mentioned in a short lived White Space deal with. “Your deposits might be there when you want them.”

He additionally praised the “instant” motion taken by way of officers.

Whilst america has moved to offer protection to shoppers’ deposits, Biden made transparent that the federal government would possibly not be bailing out the financial institution’s buyers.

Supply Through https://www.channelnewsasia.com/trade/silicon-valley-bank-timeline-rise-and-fall-banking-sector-3345466